Acceptable. Vida Homeloans offers Consumer Buy to Let to Expatriates up to a maximum of 75% LTV on Vida 36.

Introducing our Consumer Buy to Let range

Our Consumer Buy to Let range is built for accidental and non-professional landlords—offering a simpler, safer way into the regulated market with the protection your clients deserve.

Get the Scoop on Consumer Buy to Let

A consumer buy-to-let mortgage is designed for individuals who become landlords unintentionally - often referred to as 'accidental' landlords.

Unlike traditional buy-to-let mortgages, Consumer Buy to Let mortgages are regulated by the Financial Conduct Authority (FCA).

The key difference lies in the level of protection - because accidental landlords may be less familiar with the responsibilities of property letting, FCA regulation helps safeguard their interests and mitigate potential risks.

Help in Spotting a Consumer Buy to Let application

Key information

We accept remortgages up to 80% LTV on our Vida 36 tier for:

- Inherited properties

- Let to Buy and Let to Rent applicants

- Let to Move, including an acceptance of applicants regardless of whether there is an onward purchase

- CBTL for Worldwide Expats up to 75% LTV.

- This excludes HMO and MUB properties.

Additional Information: Consumer Buy to Let

Vida Homeloans will consider Let to Buy or Let to Rent applications for the BTL mortgage to allow the existing property to be let out. Vida does not currently lend on both the BTL and the new residential purchase.

Read all about our Let to Move proposition

HMOs and MUBs are not acceptable for Consumer BTL applications.

Vida Homeloans can consider an application for a mortgage on an inherited property under the following conditions:

- The will must have been through Probate

- If the applicant or the applicant’s family have occupied the property and are applying as an individual then, and have not got other BTLs, this will be classified as Consumer BTL. If they are applying through a SPV then Standard BTL products and policy will apply

- The applicant must show as the current owner at Land Registry (evidence of a pending application can be considered)

Download our Criteria Guide Download our BTL Product Guide

Spotting a Consumer BTL

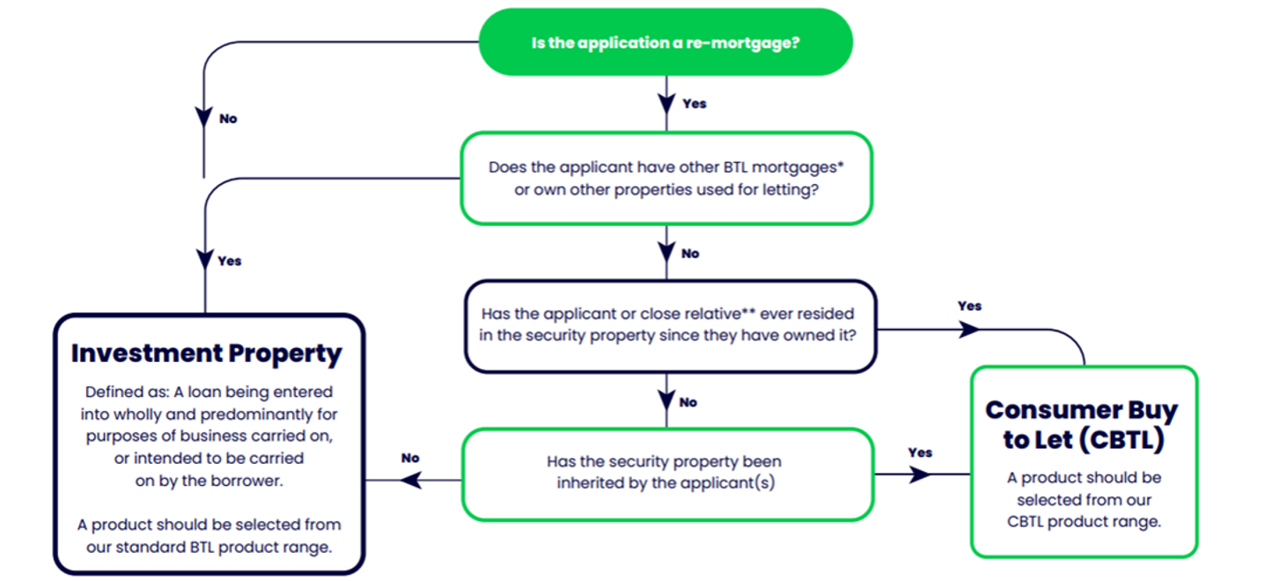

This decision tree should be followed for each applicant to identify a Consumer Buy to Let application for the purpose of out BTL lending criteria

*A Buy to let mortgage is a mortgage that, at the point it was taken out, was for business purposes and contains conditions preventing the borrower, or their relatives, from occupying the property at the time. **Close Relative: Relatives are an applicant's spouse or civil partner, parent, sister, brother, child, grandparent or grandchild. (This includes scenarios such as stepparents/children.)

Why Vida?

Flexible criteria

From Portfolio landlords to Expats to HMOs — We’ve Got BTL Covered. Search our BTL criteria

Enhanced affordability

Check BTL affordability instantly — no login, no DIP. Try our BTL Affordability Calculator

Intermediary support

Get direct access to the Underwriter handling your case through the V-Hub.

Service Excellence

Service excellence or we'll refund the administration fee. Our Service Pledge is as simple as that.

Got what you need?

Got questions? We’ve got answers—clear, quick, and straight to the point.

Call the V-Hub on 03300 246 246 and speak to our experienced team:

- Monday: 9am – 5pm

- Tuesday: 9am – 5pm

- Wednesday: 9am – 5pm

- Thursday: 9am – 5pm

- Friday: 10am - 5pm

Already have everything you need? You can login to the Broker Portal to start a new mortgage application or head over to our Product Switch Hub to switch an existing customer to a new deal.

Login to our Broker Portal Visit the Product Switch Hub

You can always ask Mobi.

Mobi is your always-on digital assistant, designed specifically for brokers. Mobi delivers instant, helpful answers to your questions about Vida’s lending criteria, product range, and more when you need them.