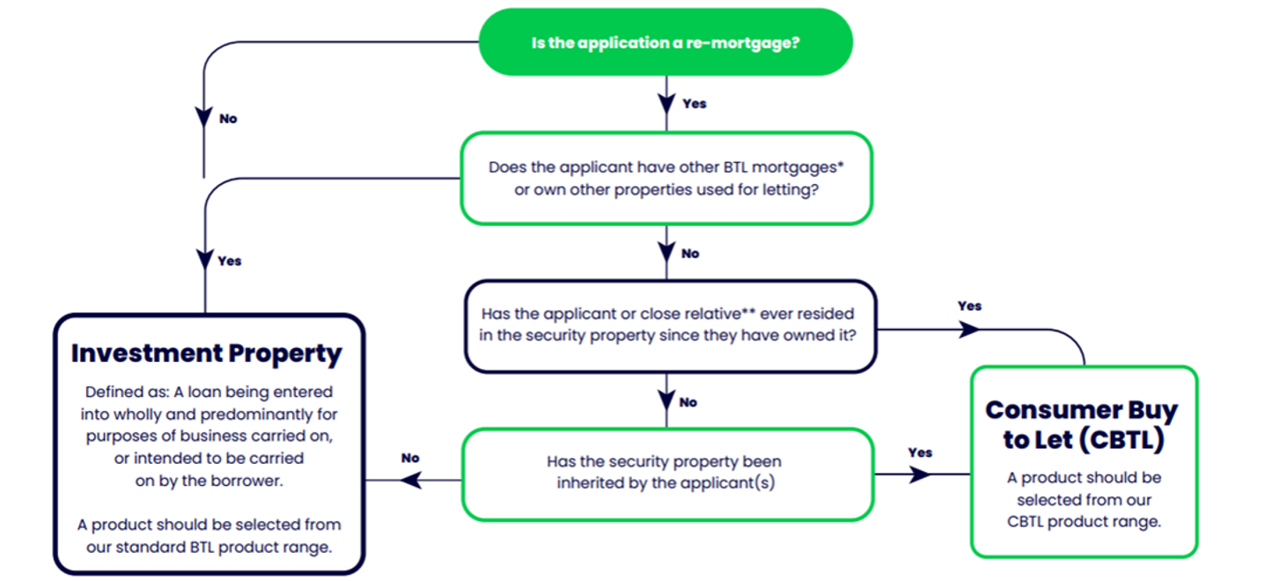

The flow chart will help you determine, which product should be selected for your client.

*A Buy to let mortgage is a mortgage that, at the point it was taken out, was for business purposes and contains conditions preventing the borrower, or their relatives, from occupying the property at the time. **Close Relative: Relatives are an applicant's spouse or civil partner, parent, sister, brother, child, grandparent or grandchild. (This includes scenarios such as stepparents/children.)