Customer Support

At Vida, we recognise that anyone can be or become vulnerable at any point in their life, and some customers may be at a higher risk of harm than others. The FCA definition of a vulnerable customer is someone who, due to their personal circumstances, is especially susceptible to harm, particularly when a firm is not acting with appropriate levels of care.

At our core, we believe there's more to a person than just a credit score. That’s why our dedicated team of experienced underwriters takes the time to look at each case individually, considering the full picture.

We understand that life can throw unexpected changes your way, and those changes can affect financial situations. By working closely with both our intermediary partners and our customers, we’re able to better understand the challenges some people face. It’s important to us that we continue to work together to offer the right kind of support—helping to ease the pressure and, where possible, tackle the root causes of financial stress.

Vulnerable customers

We want to make it as easy as possible to assist intermediary partners with identifying and flagging vulnerability markers, so our customers get the support they need and don't need to mention this over and over again.

We have created a guide to assist you in identifying vulnerable customers. This useful guide also lists all the FCA-defined vulnerability markers, which can be used when speaking with your customers, and contains some helpful links and numbers for relevant charities, support services, and financial advice groups depending on the vulnerability.

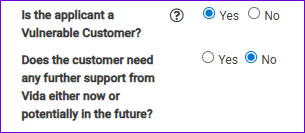

The option shown will be present at the start of the process and should be ticked to 'Yes', If you have a client that you've identified as vulnerable and they are happy to disclose the vulnerability to us.

If you have a customer that you've identified as vulnerable and they are happy to disclose the vulnerability to us, please ensure you make us aware within the application. The option shown will be presented at the start of the process and should be ticked to Yes.

This will trigger a mandatory document for the Vulnerability Questionnaire to be submitted to us.

This form allows you to detail the specific vulnerability and call out any additional support that is required from Vida Homeloans.

For any existing Vida Homeloans customers who are in financial difficulty or need specialist support, please advise them to call us on 0344 892 0155. If you'd like to deal with this on their behalf, we will need a signed letter from your customer giving authority for you to do so, or for our customer to be present when you call.